Finance and AccountingPersonal Finance

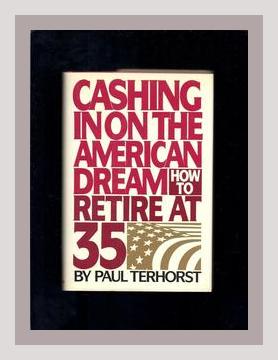

“Cashing in on the American Dream” by Paul Terhorst, published in 1988, is a personal finance book aimed at providing a clear blueprint for achieving early retirement. Terhorst, himself an early retiree, outlines practical steps and strategies to transition from a traditional working life to one of financial independence and leisure. Here’s a structured summary of the key points from the book, along with concrete examples and actionable steps derived from Terhorst’s advice:

Introduction and Thesis

Paul Terhorst begins by challenging the conventional model of working until the traditional retirement age. He asserts that with disciplined savings and smart financial decisions, it’s possible to retire much earlier. The book is a manifesto for those aspiring to break free from the 9-to-5 grind before turning 50.

1. Ultimate Goal: Financial Independence

Key Point: The ultimate goal is financial independence, not just accumulating wealth.

Example: Terhorst and his wife retired in their 30s by living frugally and making smart financial choices.

Actionable Step: Determine your financial independence number – the amount needed to generate sufficient passive income to cover living expenses without working.

2. Frugality and Lifestyle Choices

Key Point: Living below your means is critical for amassing savings quickly.

Example: Terhorst and his wife tracked their expenses meticulously and avoided lifestyle inflation despite having high-paying careers.

Actionable Step: Create a budget and track all expenses. Identify and eliminate non-essential spending. Prioritize needs over wants.

3. Saving and Investing

Key Point: A high savings rate is essential to accumulate the necessary capital for early retirement.

Example: Terhorst aimed to save around 50% of his income during his working years.

Actionable Step: Aim to save a significant percentage of your income. Invest in diversified, low-fee mutual funds or index funds to grow your savings.

4. Building a Cash Cushion

Key Point: A substantial cash cushion can provide financial security and reduce stress.

Example: Terhorst recommends having a cash reserve to cover at least three years of living expenses.

Actionable Step: Build an emergency fund with sufficient liquidity to cover unforeseen expenses and provide a buffer during market downturns.

5. Geographic Arbitrage

Key Point: Living in lower-cost areas can stretch your retirement savings significantly.

Example: The Terhorsts chose to live in countries with a lower cost of living to maximize their financial resources.

Actionable Step: Consider relocating to a region or country with a lower cost of living where your retirement budget will go further, providing a higher quality of life for less money.

6. Minimizing Housing Costs

Key Point: Housing is often the largest single expense, and reducing this cost frees up substantial resources.

Example: Terhorst recommends renting instead of owning a home to avoid the hidden costs of homeownership.

Actionable Step: Evaluate whether renting or downsizing could be more cost-effective than owning. Consider house hacking or co-living arrangements to decrease monthly housing expenses.

7. Understanding the 4% Rule

Key Point: The 4% rule is a guideline to determine how much can be safely withdrawn from your retirement savings annually.

Example: If you have $1 million in retirement savings, you can withdraw $40,000 annually based on the 4% rule.

Actionable Step: Calculate your annual expenses and determine the total amount needed in your retirement portfolio to sustain that level of spending using the 4% rule. Adjust your savings goals accordingly.

8. Avoiding Debt

Key Point: Debt is a significant obstacle to achieving financial independence and should be minimized.

Example: Terhorst avoided accumulating consumer debt and paid off any loans as quickly as possible.

Actionable Step: Focus on eliminating high-interest debt first. Avoid taking on new debt by living within your means and using cash or debit for purchases.

9. Understanding Tax Implications

Key Point: Efficient tax planning can preserve more of your wealth.

Example: Terhorst highlights strategies to minimize tax liabilities, such as investing in tax-advantaged accounts.

Actionable Step: Maximize contributions to tax-advantaged retirement accounts like IRAs and 401(k)s. Consider consulting with a tax professional to optimize your financial plan and understand the tax implications of your retirement strategy.

10. Health Insurance Considerations

Key Point: Health insurance is a critical component of retirement planning.

Example: The Terhorsts explored international health insurance options and found plans that were both affordable and comprehensive.

Actionable Step: Research and compare health insurance plans. Consider high-deductible health plans combined with Health Savings Accounts (HSAs) or international insurance if you’re planning to live abroad.

11. The Psychological Aspect of Retirement

Key Point: The transition to retirement requires psychological preparation and adjustments.

Example: Terhorst emphasizes the importance of having hobbies, interests, and activities to maintain a fulfilling life post-retirement.

Actionable Step: Cultivate hobbies and interests that you can pursue in retirement. Develop a plan for how you will spend your time and stay engaged and socially active.

12. Income Strategies Post-Retirement

Key Point: Generating some income post-retirement can provide financial security and personal fulfillment.

Example: Terhorst suggests considering part-time work, freelance opportunities, or passive income streams like rental properties or dividends.

Actionable Step: Identify skills or hobbies that could generate income. Explore opportunities for part-time work, consulting, or developing passive income streams that align with your interests.

13. Continuous Monitoring and Adjustments

Key Point: Regularly reassessing and adjusting your financial plan is essential.

Example: Terhorst periodically reviewed his financial situation to ensure his investments were aligned with his retirement goals.

Actionable Step: Schedule regular reviews of your financial plan, at least annually. Adjust your investments, spending, and saving strategies as needed based on market conditions and personal circumstances.

Conclusion

In conclusion, “Cashing in on the American Dream” provides a pragmatic approach to achieving early retirement through disciplined savings, frugal living, and smart investment strategies. By following Terhorst’s advice, individuals can break free from the traditional work timeline and enjoy a financially independent and fulfilling life much earlier than they might have thought possible.

By implementing the actionable steps outlined in each key point, readers can systematically work towards their goal of early retirement. Whether through geographic arbitrage, reducing housing costs, or strategically managing investments and taxes, Terhorst’s roadmap offers a clear and achievable path to financial freedom.