Business StrategyMergers and Acquisitions

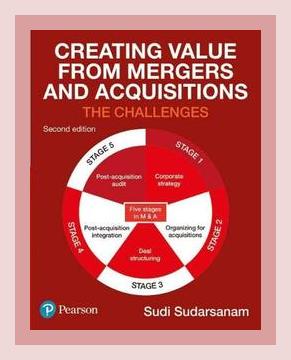

“Creating Value from Mergers and Acquisitions” by Sudi Sudarsanam, published in 2003, serves as a comprehensive guide to understanding the complex dynamics of mergers and acquisitions (M&A). It dissects the financial, strategic, and operational elements that can determine the success or failure of such corporate moves. The book is methodologically detailed, concrete in its examples, and rich in actionable insights. This summary will outline the book’s major points and provide practical takeaways derived from Sudarsanam’s analysis.

1. Understanding the Basics of Mergers and Acquisitions

Sudarsanam starts by elucidating the foundational concepts of mergers and acquisitions, emphasizing their importance in corporate strategy. He identifies the primary forms of M&A: horizontal, vertical, and conglomerate mergers, each having distinct strategic implications.

Key Points:

– Horizontal Mergers: Occur between companies in the same industry, aimed at achieving economies of scale.

– Vertical Mergers: Involve companies at different stages of the production process, focusing on supply chain efficiency.

– Conglomerate Mergers: Deal with companies in unrelated businesses, looking to diversify risk.

Actionable Advice:

– Evaluate Strategic Fit: Before engaging in any M&A, a company should assess whether the merger or acquisition aligns with its long-term strategic goals. Perform a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) to ensure compatibility.

2. The Financial Evaluation of M&A

Sudarsanam provides a detailed methodology for the financial evaluation of potential mergers and acquisitions. This includes valuation techniques such as Discounted Cash Flow (DCF), Comparable Company Analysis, and Precedent Transactions.

Key Points:

– Discounted Cash Flow (DCF): Estimates the value of an investment based on its expected future cash flows.

– Comparable Company Analysis: Uses the valuation metrics of similar publicly traded companies to gauge the target company’s value.

– Precedent Transactions: Involves looking at past M&A deals in the same industry to understand valuation multiples.

Actionable Advice:

– Conduct Rigorous Valuation: Implement DCF analysis to project future cash flows and discount them to present value. This helps in determining a fair acquisition price and avoids overpaying.

3. Sources of Value Creation

The book highlights various sources of value creation in M&A, including operational synergies, financial synergies, and managerial efficiencies. Sudarsanam stresses that identifying and leveraging these synergies is crucial for a successful M&A.

Key Points:

– Operational Synergies: Cost savings and revenue enhancements achieved by combining operations.

– Financial Synergies: Tax benefits and improved borrowing capacity arising from the merger.

– Managerial Efficiencies: Enhanced management capabilities and better decision-making processes.

Actionable Advice:

– Identify Synergy Opportunities: Create a post-merger integration plan focusing on combining operations, optimizing the supply chain, and harnessing cross-selling opportunities to maximize synergies.

4. Cultural Integration

Sudarsanam underscores the importance of cultural integration in the success of mergers and acquisitions. Diverse corporate cultures can lead to friction and undermine the anticipated benefits of a merger.

Key Points:

– Cultural Due Diligence: Conduct thorough assessments of the organizational cultures involved.

– Employee Engagement: Proactively engage employees to foster a collaborative culture.

– Change Management: Implement structured change management processes to ease transitions.

Actionable Advice:

– Foster Inclusive Culture: Develop a change management plan that includes frequent communication, training programs, and integration workshops to blend the different corporate cultures effectively.

5. Due Diligence

Due diligence is critical in uncovering potential liabilities and risks associated with a target company. Sudarsanam details the areas that need thorough examination, such as legal, financial, and operational aspects.

Key Points:

– Legal Compliance: Evaluate compliance with regulatory requirements and potential legal issues.

– Financial Health: Scrutinize financial statements for hidden liabilities.

– Operational Efficiency: Assess the efficiency of the target’s operations.

Actionable Advice:

– Conduct Comprehensive Due Diligence: Assemble a cross-functional team to conduct thorough due diligence, including financial audits, legal assessments, and operational reviews.

6. Negotiation Tactics

Sudarsanam provides strategies for effective negotiation during M&A deals, emphasizing preparation, understanding the counterpart’s motivations, and creating win-win scenarios.

Key Points:

– Preparation: Gather extensive information and enter negotiations well-prepared.

– Motivations: Understand the interests and motivations of the counterpart.

– Win-Win Outcomes: Aim for mutually beneficial solutions rather than zero-sum outcomes.

Actionable Advice:

– Prepare Thoroughly: Develop a detailed negotiation strategy, anticipate potential counterarguments, and focus on creating value for both parties involved in the deal.

7. Structuring the Deal

The structure of a deal can have significant implications for the success of an M&A transaction. Sudarsanam explores various deal structures, such as stock purchases, asset purchases, and mergers, and their respective advantages and challenges.

Key Points:

– Stock Purchase: Involves buying the target company’s shares directly.

– Asset Purchase: Entails purchasing specific assets and liabilities of the target company.

– Mergers: Combining two entities into a single legal entity.

Actionable Advice:

– Choose Optimal Deal Structure: Assess the financial, legal, and tax implications of various deal structures to determine the most beneficial arrangement for both parties.

8. Financing M&A Transactions

Financing is a crucial aspect of M&A projects. Sudarsanam explores different financing options, including cash transactions, stock swaps, debt financing, and hybrid models.

Key Points:

– Cash Transactions: Immediate payment using liquid assets.

– Stock Swaps: Using the acquiring company’s shares to pay for the target company.

– Debt Financing: Borrowing funds to finance the M&A deal.

Actionable Advice:

– Evaluate Financing Options: Consider the cost, availability, and impacts of each financing option on the company’s balance sheet and shareholder value, and select the most appropriate method.

9. Post-Merger Integration

The importance of the post-merger integration (PMI) process cannot be overstated. Sudarsanam stresses effective PMI as essential for realizing anticipated synergies and ensuring the smooth operation of the combined entity.

Key Points:

– Integration Planning: Develop comprehensive integration plans before finalizing the deal.

– Execution: Execute the integration plan efficiently, focusing on quick wins and long-term goals.

– Monitoring: Continuously monitor and adjust the integration plan as needed.

Actionable Advice:

– Create Detailed PMI Plan: Prepare a post-merger integration roadmap with clear milestones, responsibilities, and timelines to ensure a seamless transition.

10. Real-Life Examples and Case Studies

Throughout the book, Sudarsanam illustrates his points with numerous real-life examples and case studies. For instance, he discusses the merger of Daimler-Benz and Chrysler to highlight the cultural clash and integration challenges that can arise.

Key Points:

– Daimler-Benz and Chrysler: The merger failed to achieve the anticipated synergies due to significant cultural differences and poor integration planning.

– Vodafone and Mannesmann: Demonstrates successful cross-border M&A through effective integration and realization of synergies.

Actionable Advice:

– Learn from Case Studies: Analyze past M&A deals, both successful and unsuccessful, to understand best practices and potential pitfalls.

11. Regulatory and Legal Considerations

Sudarsanam emphasizes the importance of understanding the regulatory and legal landscape governing M&A activities. Compliance with antitrust laws, securities regulations, and other legal frameworks is crucial.

Key Points:

– Antitrust Laws: Prevent anti-competitive practices and monopolistic market behavior.

– Securities Regulations: Govern the disclosure and trading of securities during M&A.

Actionable Advice:

– Ensure Legal Compliance: Engage legal experts to navigate regulatory complexities and ensure compliance with all relevant laws and regulations during the M&A process.

Conclusion

“Creating Value from Mergers and Acquisitions” by Sudi Sudarsanam is a comprehensive and practical guide to navigating the complex world of M&A. The book stresses the importance of strategic alignment, thorough due diligence, effective negotiation, optimal deal structuring, and meticulous post-merger integration. Leveraging Sudarsanam’s insights and advice, companies can better position themselves to create substantial value from their M&A endeavors.

By following these actionable steps, organizations can approach M&A with a strategic mindset, mitigate risks, and maximize the potential for achieving operational and financial synergies – ultimately leading to greater shareholder value and sustainable growth.